Allegro Allwell Financing Review 2023: Is Allwell Hearing Aid Financing Good?

When it comes to navigating the world of finance, Allwell Financing has established itself as a reliable and customer-centric institution. With a range of services designed to meet the diverse needs of individuals and businesses, Allwell Financing aims to empower customers on their financial journey. In this comprehensive review, we will explore the various services offered by Allwell Financing, their application process, customer experience, rates, and more. By the end, you’ll have a clearer understanding of what Allwell Financing brings to the table and how it can benefit you.

Allwell Financing Overview

Allwell Financing has been a trusted name in the financial industry for over a decade. Established by a team of seasoned professionals, the company’s mission is to provide accessible and flexible financial solutions to individuals and businesses alike. With a strong foundation and a commitment to customer satisfaction, Allwell Financing has grown to become a recognized player in the market.

Allwell Financing Services

Loans

Allwell Financing offers a wide range of loan options tailored to meet various needs. Whether you’re looking for a personal loan to fund a home renovation project or a business loan to expand your company, Allwell Financing has you covered. Their competitive interest rates and flexible repayment terms make borrowing convenient and affordable.

Credit Cards

Allwell Financing’s credit card options provide customers with a convenient and secure way to manage their finances. With features such as cashback rewards, travel benefits, and comprehensive fraud protection, Allwell Financing credit cards offer a seamless and rewarding experience. Choose from a range of cards that suit your spending habits and financial goals.

Investment Solutions

Allwell Financing understands the importance of building wealth and securing your financial future. That’s why they provide a variety of investment options to help you grow your money. Whether you’re a seasoned investor or just starting, Allwell Financing offers mutual funds, retirement plans, and other investment vehicles to diversify your portfolio and maximize your returns.

Allwell Financing Application Process

Applying for financing with Allwell Financing is a straightforward and hassle-free process. Here’s a step-by-step guide to help you get started:

Research and Compare

Take the time to explore Allwell Financing’s loan options, credit cards, and investment solutions. Consider factors such as interest rates, fees, and terms to find the product that best aligns with your financial goals.

Online Application

Once you’ve decided on a specific product, visit the Allwell Financing website and complete the online application form. Provide accurate information and ensure that all required fields are filled.

Document Submission

As part of the application process, you may need to submit supporting documents such as identification proof, income statements, and bank statements. Allwell Financing will specify the required documents, and you can conveniently upload them online.

Application Review

Allwell Financing’s dedicated team will review your application and assess your eligibility. They may contact you for any additional information or clarification during this process.

Approval and Disbursement

If your application is approved, you will receive a notification from Allwell Financing. The funds will be disbursed according to the agreed-upon terms and conditions. For credit card applications, you will receive your card along with instructions on how to activate and use it.

Customer Experience and Satisfaction

At Allwell Financing, customer satisfaction is a top priority. Here’s what customers have to say about their experience with Allwell Financing:

Positive Reviews and Feedback

Customers consistently highlight Allwell Financing’s easy-to-use online application process, competitive rates, and responsive customer support. Many appreciate the personalized approach and the feeling of being valued as individuals.

Commitment to Transparency

Allwell Financing’s transparent practices and clear communication set them apart. Customers appreciate the absence of hidden fees or unexpected charges, allowing them to make informed financial decisions.

Testimonials and Success Stories

Numerous customers have shared their success stories, highlighting how Allwell Financing’s services have helped them achieve their financial goals. Whether it’s funding a dream vacation or launching a business, customers have found Allwell Financing to be a reliable partner on their journey to financial success.

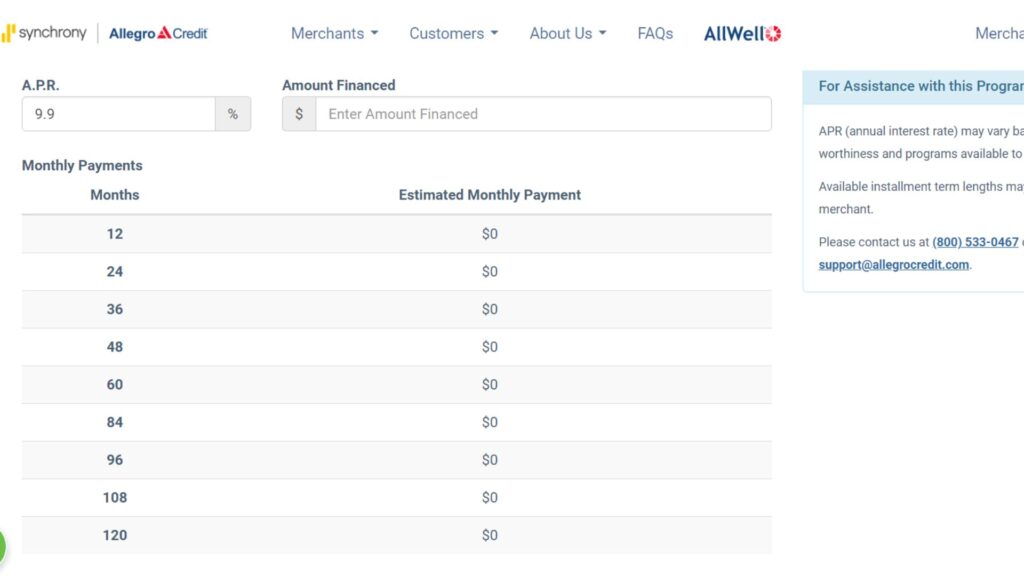

Allwell Financing Rates and Fees

Understanding the rates and fees associated with Allwell Financing’s services is crucial for making informed financial decisions. Here’s what you need to know:

Competitive Interest Rates

Allwell Financing offers competitive interest rates on their loans and credit cards. The specific rates will depend on factors such as your creditworthiness and the product you choose. It’s advisable to review the terms and conditions to understand the applicable rates and any potential fluctuations.

Transparent Fee Structure

Allwell Financing believes in transparency when it comes to fees. While there may be certain charges associated with their services, such as annual fees for credit cards or processing fees for loans, these will be clearly communicated to you during the application process. Make sure to familiarize yourself with the fee structure to avoid any surprises.

Security and Privacy Measures

Allwell Financing understands the importance of safeguarding your personal and financial information. Here’s how they prioritize security and privacy:

Robust Security Protocols

Allwell Financing employs industry-standard security protocols to protect customer data. This includes the use of encryption technologies, secure servers, and regular security audits to identify and address potential vulnerabilities.

Data Protection and Privacy

Allwell Financing adheres to relevant privacy regulations and guidelines to ensure the confidentiality of your personal information. They have strict policies in place to prevent unauthorized access or misuse of customer data.

Allwell Financing’s Strengths and Weaknesses

To provide a well-rounded review, let’s consider the strengths and weaknesses of Allwell Financing:

Strengths

- A diverse range of financial products to cater to various needs

- Competitive interest rates and transparent fee structure

- Positive customer feedback and testimonials

- Robust security measures to protect customer information

Weaknesses

- Limited physical branch network, primarily operating online

- Availability of certain services may vary by region

- Comparison with Competitors:

To help you make an informed decision, let’s compare Allwell Financing with other similar financial institutions. Consider the following factors:

Range of Services

Allwell Financing offers a comprehensive suite of financial products, giving customers access to a wide range of solutions. This breadth of options sets them apart from some competitors that may have a more limited offering.

Customer-Centric Approach

Allwell Financing’s commitment to customer satisfaction and its personalized approach stands out in the industry. Their focus on building long-term relationships with customers contributes to a positive experience.

Conclusion

Allwell Financing is a trusted financial institution that strives to empower individuals and businesses on their financial journeys. With a diverse range of services, a customer-centric approach, and competitive rates, Allwell Financing offers solutions to meet various needs. Whether you’re looking to borrow, build credit, or invest, Allwell Financing has you covered. Take advantage of their user-friendly online application process and begin your financial journey with confidence.

Is it safe to consider Allwell Financing Reviews?

If you’re considering Allwell Financing, here are some recommendations:

Research and Compare

Take the time to research and compare Allwell Financing’s offerings with other financial institutions. Consider factors such as interest rates, fees, and customer reviews to ensure the best fit for your needs.

Evaluate Your Financial Goals

Before applying for any financial product, evaluate your financial goals and assess how Allwell Financing’s services align with them. This will help you make an informed decision.

Remember, it’s always advisable to read the terms and conditions carefully and seek professional advice if needed before committing to any financial product.

For more unique reviews of various products and services, visit articlesaur.com.

FAQ’s

What is Allwell Financing?

Allwell Financing is a financial institution that offers a range of services, including loans, credit cards, and investment solutions. They aim to provide accessible and flexible financial solutions to individuals and businesses.

How long has Allwell Financing been in operation?

Allwell Financing has been operating for over a decade, establishing itself as a trusted name in the financial industry.

What types of loans does Allwell Financing offer?

Allwell Financing provides various types of loans, including personal loans and business loans. These loans cater to different financial needs and come with competitive interest rates and flexible repayment terms.

Can I apply for a loan or credit card online?

Yes, Allwell Financing offers an online application process for loans and credit cards. Their user-friendly website allows you to conveniently apply from the comfort of your own home.

What documents are required for the application process?

The specific documentation requirements may vary depending on the type of financial product you are applying for. Generally, you may need to provide identification proof, income statements, and bank statements. Allwell Financing will specify the necessary documents during the application process.